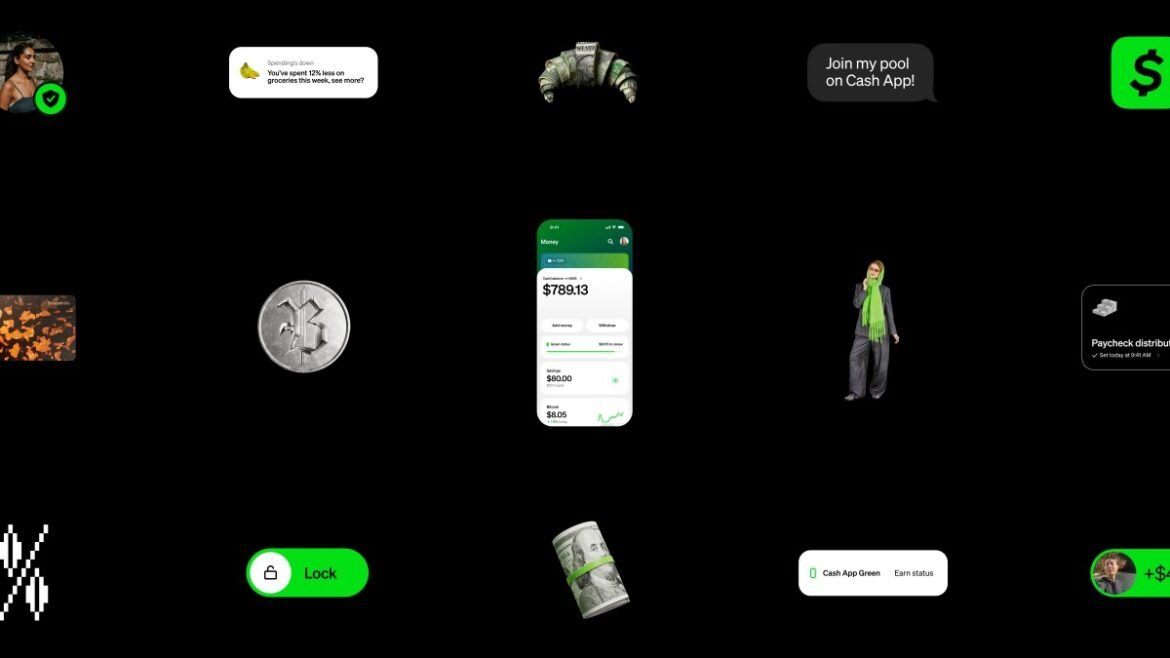

Cash App released a slate of new features as part of its fall update, including an AI chatbot that can answer questions about users’ finances, a new benefits program, and the ability to discover places that accept Bitcoin payments and make Bitcoin payments using USD.

The company is launching an assistant called Moneybot that can answer questions about spending patterns and income, and provide insights for maintaining savings and setting aside money for investments.

The chatbot will be available to select users at launch, with broader availability planned for the coming months. Users can ask questions like “Can you show me my monthly income, expenses, and spending patterns?” to get reports about their accounts. The bot also surfaces suggestions for actions like splitting a bill, checking a bitcoin balance, or requesting money from someone.

“Consumers today are given a host of data around their financial transactions and account balances, but Moneybot takes it a step further by helping to turn those insights into action. No two financial journeys are the same, so we’ve built Moneybot to learn each customer’s habits and tailor its suggestions in real-time,” Cameron Worboys, head of product design at Cash App, said in a statement.

Jack Dorsey-led Block, which owns Cash App and Square, has been creating new ways to promote Bitcoin payments. Last month, it released an integrated Bitcoin solution for merchants to easily receive the cryptocurrency into a wallet. Customers can now discover places that accept Bitcoin through a new map and use USD to pay in cryptocurrency without holding it. The company said it uses the Lightning Network, a layer-2 payment network built on top of Bitcoin, to facilitate transactions via QR codes.

The company said that soon it will also allow some customers to send and receive stablecoins through the app.

Block is also changing the benefits structure for Cash App customers. Previously, customers who had direct deposits of at least $300 per month qualified for benefits like a 3.5% yield. Now, the company is starting a new program called Cash App Green, where users who either spend $500 or more per month through the Cash App Card or Cash App Pay, or receive deposits or at least $300, qualify for benefits.

Techcrunch event

San Francisco

|

October 13-15, 2026

These benefits will include a higher borrowing limit — up to $400 for first-time borrowers and a limit increase of up to $300 for others; free overdraft coverage of up to $200 for Cash App Card transactions; free in-network ATM withdrawals; up to 3.5% annual percentage yield (APY) on savings balances; and five customized weekly offers at different stores.

Block said that this new program will make up to 8 million accounts eligible for benefits under the Cash App Green program.

The company is also offering a 3.5% APY for teen accounts without any balance limits. Other features in this release include expansion of the Cash App Borrow product to 48 states, and access to some Afterpay buy now pay later (BNPL) services and features within the Cash App without needing a separate login.