Inertia Enterprises has raised $450 million to build one of the world’s most powerful lasers, which it hopes will serve as the foundation of a grid-scale power plant the fusion startup intends to start construction on in 2030.

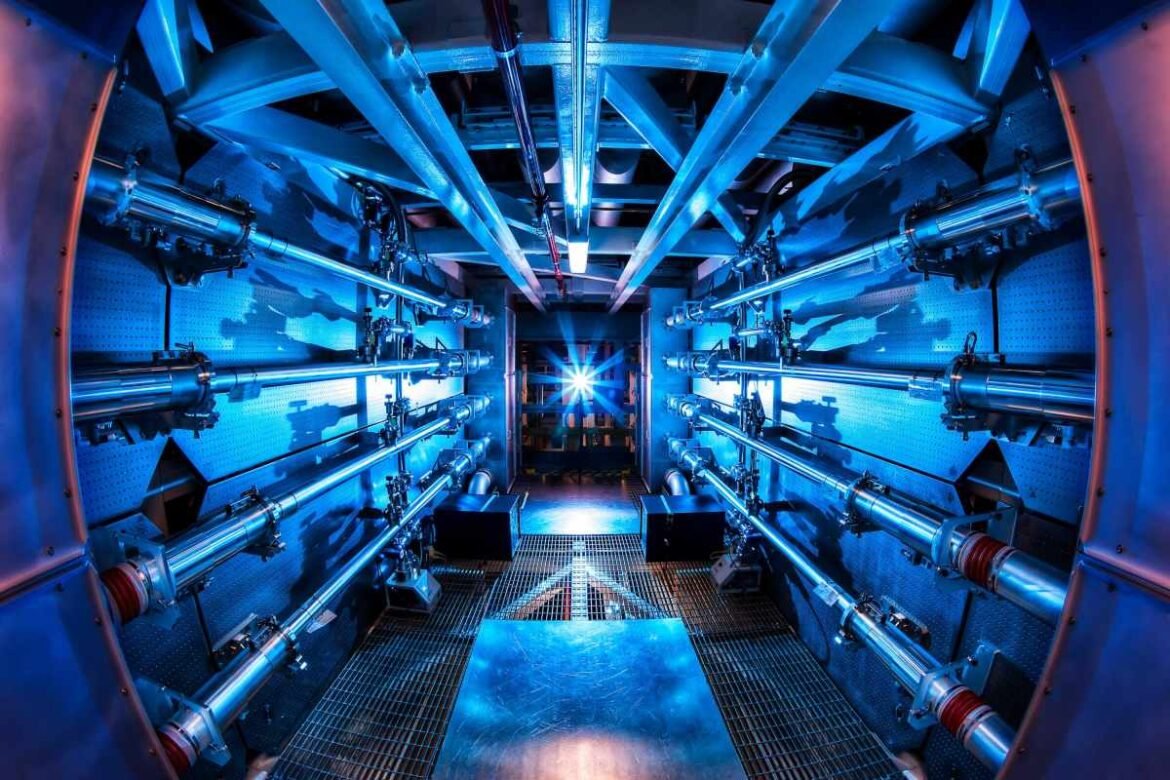

Inertia Enterprises is building on technology developed at the Lawrence Livermore National Laboratory’s National Ignition Facility. The NIF is the site of the world’s only controlled fusion reactions that have reached scientific breakeven, in which the reaction releases more energy than it took to start.

The Series A was led by Bessemer Venture Partners with participation from GV, Modern Capital, Threshold Ventures, and others. Inertia’s co-founders include Jeff Lawson, who co-founded Twilio and served as its CEO, Annie Kircher, who led the successful experiments at NIF, and Mike Dunne, a Stanford professor who helped Lawrence Livermore develop a power plant design based on NIF. Kircher has remained in her position at Lawrence Livermore.

NIF’s breakeven experiments have been a key milestones on the road to widespread fusion power. However, considerable progress needs to be made before a fusion power plant can deliver electricity to the grid. For Inertia, that means building a laser capable of delivering 10 kilojoules ten times per second.

The startup’s reactor relies on a form of fusion known as inertial confinement. In Inertia’s flavor of inertial confinement, lasers bombard a fuel target, compressing the fuel until atoms inside fuse and release energy. The technique is based on NIF’s designs, in which laser light is converted into X-rays inside the target. The X-rays are what ultimately heat and compress the fuel pellet.

Each of Inertia’s power plants will require 1,000 of its lasers bombarding 4.5 mm targets that cost less than $1 each to mass produce. By contrast, the NIF’s system uses 192 lasers to fire on painstakingly crafted targets that take dozens of hours to make. Inertia is betting that by using the same basic principles as NIF and applying a more commercial mindset, it can bring the costs down dramatically.

Inertia’s new round is the latest in a string of funding announcements from fusion startups in recent months. With this round and others, fusion startups have attracted more than $10 billion in investments. And at least a dozen companies have raised more than $100 million.

Techcrunch event

Boston, MA

|

June 23, 2026

Last week, Avalanche said it had raised $29 million to advance its desktop-sized fusion reactor. Earlier this year, Type One Energy told TechCrunch it had attracted $87 million in investment in advance of a $250 million Series B that it’s currently raising. Last summer, Commonwealth Fusion Systems raised $863 million from dozens of investors, including Google, Nvidia, and Breakthrough Energy Ventures.

Two fusion companies recently announced they were going public via reverse mergers. General Fusion said in January it would merge with acquisition company Spring Valley III in a deal that values the combined company at $1 billion. General Fusion had previously struggled to raise money from private investors. Earlier last month, TAE Technologies announced it would merge with Donald Trump’s social media company, Trump Media & Technology Group; the combined company would be worth $6 billion, according to the all-stock transaction.