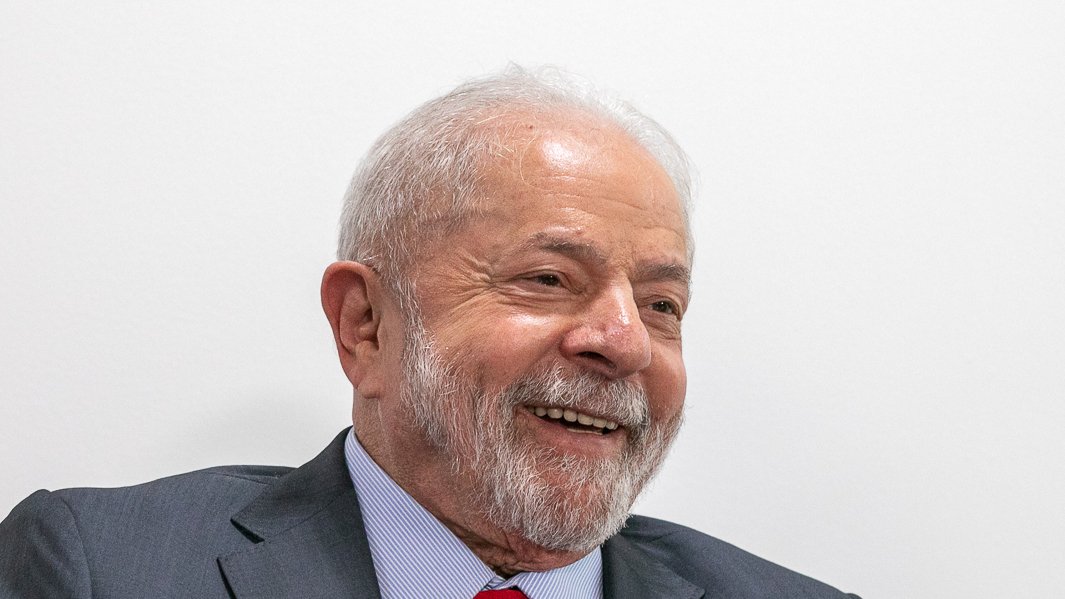

Even advisable to “lower the tone” amid the 50% gimmickness generated by 50% and under threat of new sanctions, President Luiz Inacio Lula da Silva (PT) has not hesitated to provoke Republican Donald Trump, resuming the theme of an alternative to the dollar in international business transactions. The results, according to analysts heard by Gazeta do Povothey are unpredictable. But will come.

In a statement during the inauguration of the new PT President, Edinho Silva, on Sunday (3), Lula stressed the importance of expanding Brazilian autonomy in the domain of the American currency. “I will not give up thinking that we need to try to build an alternative currency so that we can negotiate with other countries,” he said.

The discussion – which has been going on for some time in the scope of BRICS, an antagonistic bloc to the United States and has its main vocalizer in Lula – is among the main reasons for Donald Trump’s offensive to Brazil. The country is considered a spokesman for one of the group’s strategic interests, led by China.

Trump sees in the search for an alternative currency to the dollar a direct threat to the US economic hegemony and has vehemently reacted to the initiative: “There is no chance for the BRICS to replace the dollar in international trade or anywhere else, and any country they try to say ‘hello’ to tariffs and goodbye to the US,” he said.

See also:

-

The “atomic bomb” that Trump can launch against the Brazilian economy

-

Fernando Jasper: Bad the 50%rate? Because Trump can rise to 100% – or do worse

In this context, Lula’s recent speeches sound like inoportune, in an especially delicate moment. For Mauro Rochlin, from FGV-SP, the insistence on the subject has no economic rationality. “In the short term, this [uma moeda alternativa] It won’t happen, ”he says.“ Insisting on this discourse now, in the heat of events, is counterproductive and disturbs. ”

Economist Simão Silber, professor at the University of São Paulo (USP), points out: “The use of other currencies in international transactions, whether commercial or financial, is very difficult,” he says. “By tradition, contracts are already engraved in dollar. Changing this in the short term is unthinkable.”

For him, Lula’s “bravado” even “border on insanity.” “[O Brasil] It took the largest import tax on the planet, right? Fifty percent. A very large part of Brazilian products can no longer enter the United States. This is the price we paid for this bullshit that was said, ”he criticizes.

Economists warn that this can be just the beginning. With the elevation of political temperature and the failed attempts of the negotiation government, the strategy should be even more expensive. “It’s a narrative to play for the audience, to the internal audience,” says Rochlin. “And there will be consequences.”

Dollar is a symbol of geopolitical power

In addition to Trump and tariffs, overshadowing the protagonism of the American currency on the international scenario translates into a virtually unenforceable task for any country today. The dollar is not just a monetary unit – it is one of the main geopolitical power tools of the United States, firmly defended by democratic and republican governments.

The American currency dominates about 70% of international transactions, composes most countries’ currency reservations, controls major global payment systems such as SWIFT (which allows transactions between countries), and enables Washington to apply economic sanctions, freeze assets and monitor or block financial flows on a world scale.

With this, the United States maintains a significant economic advantage. Its currency is accepted internationally, and the country can pay for imports with the dollar itself.

“He gets imports from goods and services and pays in ‘painted paper’,” says Silber. This privilege, however, is not the result of chance, but of the ballast achieved by the largest economy on the planet, the economist evaluates. “They have won this right,” he says. “The currency ballast is GDP [Produto Interno Bruto].”

Today, US GDP exceeds $ 28 trillion, 12.5 times higher than Brazil and 1.55 times higher than China, according to International Monetary Fund (IMF) data. “That is, the adoption of a currency as a global standard is not random.”

See also:

-

Trump’s tariff occurs in the midst of billionaire investment from Brazilian companies in the USA

-

US investments in Brazil have tripled in the last ten years

From the gold standard to the fiduciary dollar

Since the late 19th century, there was an international monetary standard backed by gold – that is, national currencies had their value linked to the reserves. “This made them interchangeable because they all had the same ballast,” explains Mauro Rochlin.

The model collapsed with World War I, and later attempts of restoration, especially during the great depression, failed. The system suffered pressures, as countries sought competitiveness through currency devaluation. In 1944, the Bretton Woods conference marked a new international economic order.

“At that time, the countries suspended the conversion of their gold coins except the United States, which kept the convertible dollar into gold,” says the economist. Thus, the exchange between the countries was fixed over the dollar, as the US represented about 25% of world GDP, it was the world’s largest economy and the main global commercial partner. ”

This arrangement lasted until 1973, when President Nixon announced the end of gold convertibility to avoid overvaluation of the currency that impaired American imports and benefited Europeans. Since then, the dollar has become a fiduciary currency based on confidence in the size and strength of the American economy. Two years later, the world adopted the floating exchange rate regime.

Why don’t the dollar change for another coin?

For a currency to assume the role of the dollar, it would be necessary for the emitter’s economy to have a similar dimension to that of the United States, that its foreign trade was equally relevant and that countries begin to constitute reserves in this new currency.

The European Union, even with all the weight of euro and integration, cannot yet overcome the presence of the dollar in the global financial market. “The Euro may have a 15% financial presence in the world today,” says Rochlin. “China may try to tread this path, but we’re talking about decades, not years.”

Simão Silber points out that Yuan (Chinese currency unit) has a long way to gain global confidence, as the Chinese financial system is not yet fully open or transparent to international standards. “You don’t trust the Chinese currency, because there the political system is dictatorial and can change [o sistema financeiro] overnight. Someone can take a great default. In the United States, this will not happen. ”

Payment systems are incipient

Under the BRICS, the discussion about reducing dollar dependence has focused on creating alternative payment systems. The initiative is defended by those who claim that the dollar has been losing strength gradually as a global currency, as shown in the drop in the dollar’s participation in international reserves and the relegation of the US debt credit grade.

Economist Roberto Luis Troster cites examples the SMAL Currency Payment System (SML), created in 2014 in Mercosur, which allows direct transactions between national currencies without the need for conversion to the dollar. Currently 7% of trade between Brazil and Argentina operates through this system, managed by the two central banks.

Participation is small, but the system could, according to Troster, be expanded to BRICS countries. He recalls that the warning of the risks of excessive US financial system gained momentum in 2022, when Americans imposed sanctions on Russia after the invasion of Ukraine. The exclusion of Russia from Swift was one of the most symbolic measures. “This lit a yellow light,” he says.

Russia has managed to maintain its foreign trade at previous levels through the SPFs (System for the transfer of financial messages), an international payment system created by the Russians in 2014 that have been expanded to partners who fear exclusion from SWIFT.

China also seeks its own solutions, such as the CIPs (transfronted interbank payment system), to reduce its exposure to the dollar -dominated traditional financial system.

It is, however, of regional alternatives to the international financial system still very restricted on scale and global acceptance. “The global financial structure is deeply anchored in the dollar, including investments and reserves,” says Silber. “The transition would require the construction of a new infrastructure and the renegotiation of financial agreements signed over decades.”

Rochlin agrees and gives a prophetic message: “International payment systems are still widely controlled by US institutions or linked to the US financial system. This makes it very difficult to break this standard. Lula won’t be able to retire the dollar.”